Indicators on Stonewell Bookkeeping You Need To Know

The Facts About Stonewell Bookkeeping Uncovered

Table of ContentsThe Greatest Guide To Stonewell BookkeepingStonewell Bookkeeping Things To Know Before You BuyThe Stonewell Bookkeeping PDFs4 Simple Techniques For Stonewell BookkeepingThe Stonewell Bookkeeping PDFs

Below, we address the concern, how does bookkeeping help a service? In a feeling, bookkeeping publications represent a photo in time, yet just if they are upgraded often.

It can also deal with whether or not to enhance its very own payment from clients or consumers. Nonetheless, none of these conclusions are made in a vacuum as accurate numeric information have to strengthen the monetary decisions of every local business. Such information is compiled through bookkeeping. Without an intimate expertise of the dynamics of your cash money flow, every slow-paying customer, and quick-invoicing financial institution, ends up being a celebration for anxiousness, and it can be a laborious and dull job.

You understand the funds that are available and where they drop short. The information is not always great, however at the very least you understand it.

Stonewell Bookkeeping Can Be Fun For Anyone

The puzzle of reductions, credits, exceptions, routines, and, certainly, fines, suffices to just give up to the internal revenue service, without a body of efficient documents to sustain your claims. This is why a committed accountant is very useful to a small organization and deserves his/her weight in gold.

Having this information in order and close at hand allows you submit your tax obligation return with convenience. To be certain, a service can do whatever right and still be subject to an Internal revenue service audit, as numerous already know.

Your organization return makes claims and representations and the audit targets at validating them (https://hub.docker.com/u/hirestonewell). Great bookkeeping is all regarding connecting the dots between those depictions and fact (small business bookkeeping services). When auditors can follow the info on a ledger to invoices, bank statements, and pay stubs, among others papers, they rapidly learn of the expertise and stability of the service organization

8 Easy Facts About Stonewell Bookkeeping Shown

In the exact same means, haphazard bookkeeping adds to tension and stress and anxiety, it also blinds entrepreneur's to the potential they can recognize in the lengthy run. Without the details to see where you are, you are hard-pressed to establish a location. Only with easy to understand, detailed, and accurate information can a company owner or monitoring group story a program for future success.

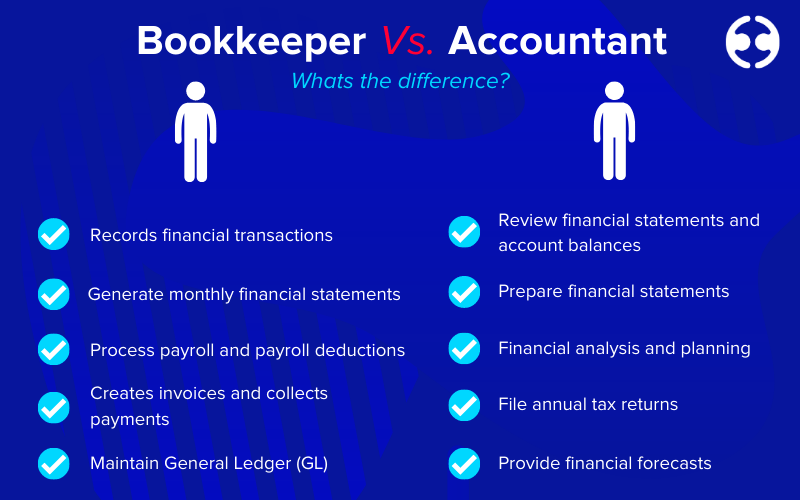

Local business owner understand best whether an accountant, accounting professional, or both, is the appropriate service. Both make crucial contributions to an organization, though they are not the exact same occupation. Whereas a bookkeeper can gather and arrange the details needed to sustain tax prep work, an accountant is much better fit to prepare the return itself and truly examine the earnings statement.

This short article will dig right into the, consisting of the and how it can benefit your company. We'll also cover exactly how to get going with bookkeeping for a sound monetary footing. Bookkeeping involves recording and arranging financial deals, consisting of sales, purchases, repayments, and receipts. It is the process of maintaining clear and concise documents so that all monetary info is quickly accessible when required.

By frequently upgrading financial documents, accounting aids businesses. Having all the financial details quickly obtainable maintains the tax authorities completely satisfied and protects against any last-minute headache during tax obligation filings. Regular accounting makes certain well-kept and organized records - https://freeseolink.org/Stonewell-Bookkeeping_393321.html. This assists in easily r and conserves companies from the anxiety of looking for papers during due dates (Accounting).

The Single Strategy To Use For Stonewell Bookkeeping

They also want to recognize what potential the service has. These aspects can be quickly handled with bookkeeping.

Thus, accounting helps to avoid the headaches associated with reporting to investors. By maintaining a close eye on monetary records, services can set practical goals and track their development. This, in turn, cultivates far better decision-making and faster business development. Government laws frequently need services to maintain check monetary records. Regular bookkeeping guarantees that companies remain compliant and prevent any type of fines or lawful concerns.

Single-entry bookkeeping is straightforward and works best for little companies with few deals. It does not track properties and responsibilities, making it much less thorough contrasted to double-entry accounting.

What Does Stonewell Bookkeeping Mean?

This might be daily, weekly, or monthly, relying on your service's size and the volume of deals. Do not hesitate to seek aid from an accountant or accountant if you find managing your economic records challenging. If you are searching for a cost-free walkthrough with the Bookkeeping Solution by KPI, contact us today.